SLEMAN - Society 5.0 allows us to use modern-based science, for example the use of AI, robots, the Internet of Things, etc. One of the things we often do is use non-cash transactions.

The National Non-Cash Movement (GNNT) was launched by Bank Indonesia since 2014 to face the Society 5.0 era.

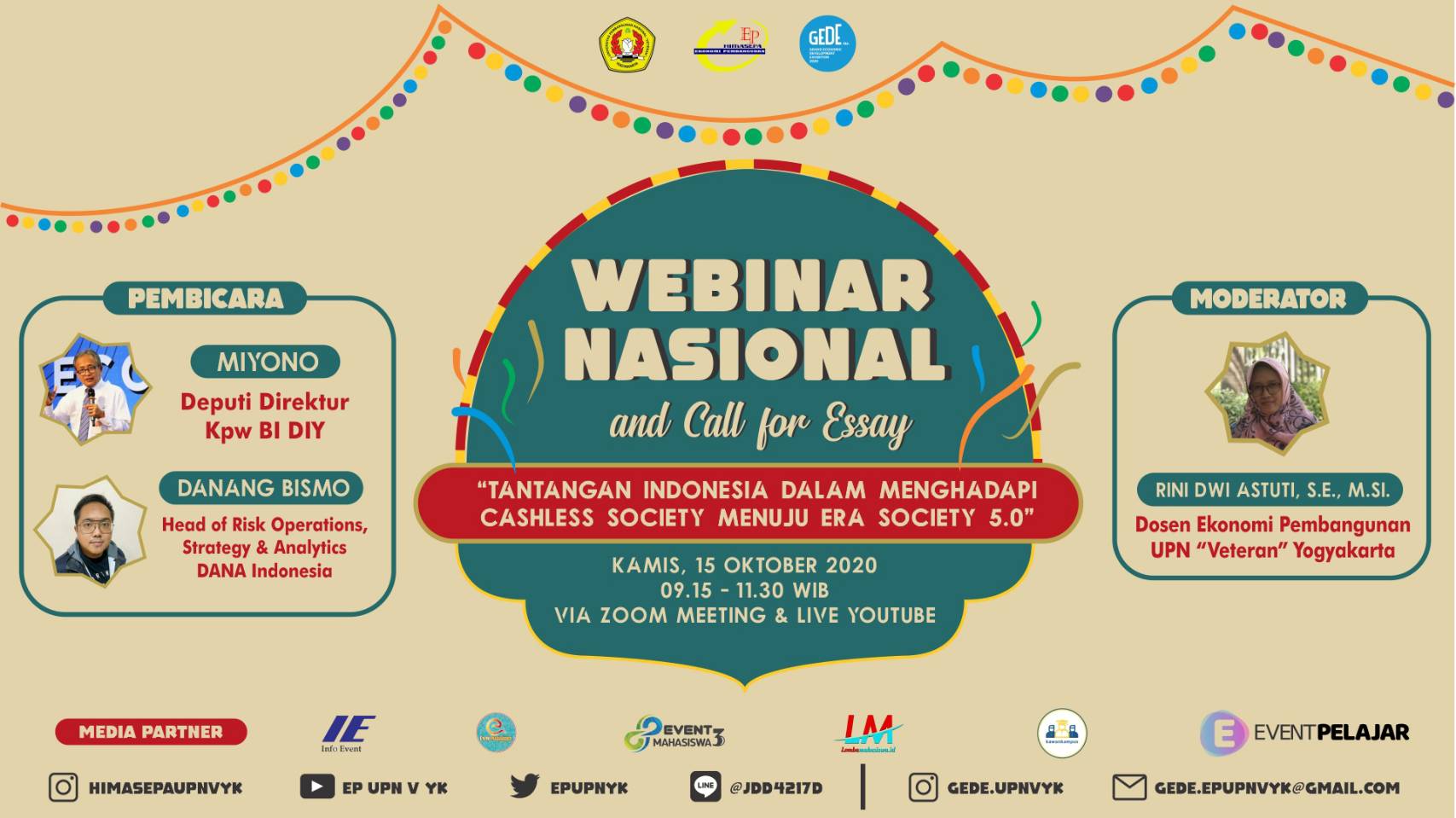

"As in October 2017, BI requires the use of e-money on toll roads. BI launched GPN (National Payment Gateway), and it launched QRIS (Quick Response Indonesian Standard) August 2019," explained the Deputy Director of Representative Office of Bank Indonesia DIY, Miyono, when he was a resource person for the National Webinar held by the Development Economics Student Association (Himasepa) UPN "Veteran" Yogyakarta, Thursday (15/10).

Miyono explained that GNNT will be held again during the Covid-19 Pandemic. According to him, the use of currency (cash) is still circulating in the community during the period, and it is risky to be a medium for virus transmission.

On the same occasion, Danang Bismo as the Head of Risk Operations, Strategy, Analytics for DANA Indonesia delivered three materials, namely Stages towards Cashless Society 5.0, Implementation of Cashless Society and Challenges in Indonesia, and the Role of Financial Industry Actors to Help Communities towards Cashless Society 5.0.

"How is the application of a cashless society and the challenges? Now, there are 270 million Indonesians and 170 million smartphone users in Indonesia, but what's interesting is that as many as 200 million Indonesians don't have access to banking." Turur Danang.

In addition, digital fraud is increasingly prevalent, ranging from malware, phishing, card not represent, counterfeit cards, and account take over (ATO). DANA as a non-bank Payment System Service Provider (PJSP) that enlivens electric payment in Indonesia also presents three superior taglines, such as trusted, friendly (easy to use), accessible (easily accessible to anyone).

Danang explained that there is a trusted aspect. DANA is equipped with Risk Management technology that guarantees 100% transaction security. On the friendly side, DANA is easy and comfortable to use, and is equipped with a variety of features needed by the people of Indonesia, and finally, DANA can be used by anyone (both consumers and business actors) with an accessible perspective.

"Life is like you have a single coin, you can spend for whatever you want, but only once you can spend,” concluded Danang Bismo.

This webinar is part of the annual Grand Economic Development Exhibition (GEDE) series. The event, which has been held for the sixth time, carries the theme of “Indonesia's Challenge in Facing Cashless Society towards Society 5.0 Era.

GEDE 2020 will be held online through a zoom meeting and a YouTube live stream @epupnvyk this year with a series of events consisting of a national essay competition with five sub-themes (economy, technology, education, social and culture) and a national webinar with the same theme.

Jl. SWK 104 (Lingkar Utara), Condongcatur, Yogyakarta 55283 (Kampus Pusat)

Jl. Babarsari 2 Yogyakarta 55281(Kampus Unit II) | Telp. +62 274 486733